As investors and stakeholders increasingly seek transparency on how capital generates social and environmental benefits, investment funds have an opportunity to demonstrate value beyond financial returns. Regulators, communities, and impact-focused investors want clear evidence of outcomes, and this is where impact reporting becomes essential.

Why Impact Reporting Matters

Impact reporting shows how investment decisions translate into social and environmental benefits. It helps funds see the effects of their investments, improve their strategies, and communicate their results.

- Reveal the outcomes of investments – Track the changes your capital creates, such as improved community well-being, reduced emissions, or increased access to essential services.

- Improve future decisions – Analyze data from past investments to understand what works and where adjustments can increase impact.

- Communicate results with credibility – Share evidence-based reports that build trust with investors, regulators, and other stakeholders.

The Theory of Change

A Theory of Change is a model that explains how and why an organization’s activities are expected to lead to specific social or environmental outcomes. It maps the pathway from the resources invested to the changes created, showing the link between actions and results.

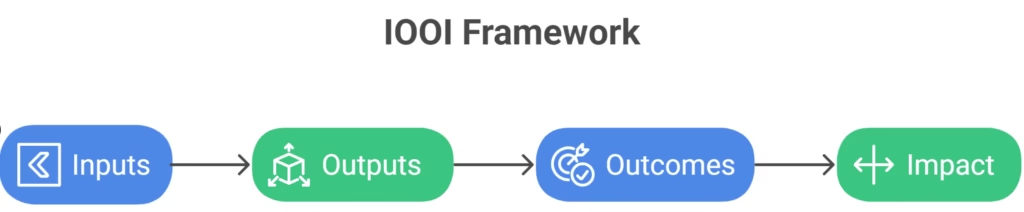

In impact reporting, this is commonly structured using the IOOI model:

- Inputs – The resources provided, such as capital, expertise, or technical support.

- Outputs – The immediate results produced from deploying these resources, for example, projects completed or services delivered.

- Outcomes – The changes experienced by stakeholders as a result of the outputs, such as improved livelihoods, better access to services, or reduced environmental harm.

- Impact – The long-term, systemic social or environmental effects that result from sustained outcomes.

Using the IOOI framework allows funds to articulate how each investment contributes to broader change. It also helps define what to measure, track, and report, making impact reporting more credible for stakeholders.

How to Create an Impact Report

Create an effective impact report by following these practical steps:

- Define your fund’s focus areas – Identify the sectors, geographies, and themes that guide your investments. This sets a clear scope for your report.

- Review frameworks and standards – Align your approach with recognized standards such as IRIS+, OPIM, or the UN SDGs to ensure credibility and comparability.

- Draft your Theory of Change – Use the IOOI framework (Inputs → Outputs → Outcomes → Impact) to map how your capital, expertise, and resources drive social and environmental outcomes.

- Collect and validate data – Gather quantitative metrics and qualitative evidence from portfolio companies, and verify their accuracy.

- Select compelling case studies – Choose projects or companies that demonstrate impact to make your report more engaging.

- Plan messaging and structure – Organize insights, highlight key lessons, and present results in a way stakeholders can easily understand.

Moving Beyond Compliance

Strategic Impact Reporting highlights the tangible social and environmental outcomes of investments. It gives investors insights into progress, helps funds optimize their strategies, and strengthens credibility with stakeholders. Most importantly, it shows how financial capital can drive meaningful change for both society and the environment.

At Envint, we help funds and institutions define impact indicators, manage portfolio company data, and align reporting with global frameworks. This ensures reports are data-driven, comparable, and meaningful for asset managers and asset owners. Our goal is to help you present impact in a way that links your investment themes with measurable outcomes. Write to us at connect@envintglobal.com to begin your impact reporting journey today.